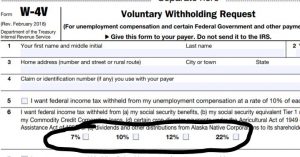

Social Security income is taxable, but you must select how much federal taxes you want withheld. The IRS form that you must use is the W-4V which allows you to choose the % amount to be withheld. The choices are provided and you must select from one of those percentages. A dollar amount is not permitted. You can change this at anytime by filing another W-4V form. Withholding federal taxes from your social security check is voluntary and each persons finances are different. Mail in your form, or for a quicker response, drop it off in person at your local Social Security office.

Effective with the February 2018 change in tax laws:

- Prior withholding amounts were 7, 10, 15 or 25%

- The new amounts are 7, 10, 12 or 22%